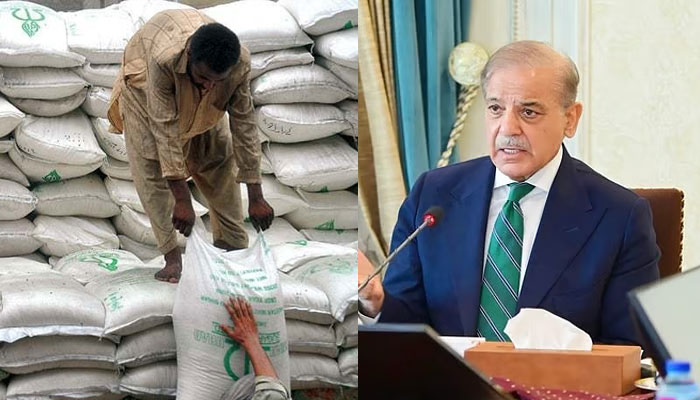

Prime Minister Mian Shehbaz Sharif has launched a major offensive against the sugar mafia by enforcing stringent taxation policies across the sugar industry. This marks perhaps the most audacious targeting of a traditional power center in Pakistan’s economy — one with deep structural links to powerful political families and entrenched industrial cartels, renowned Urdu columnist Ansar Abbasi stated in his column published in Daily Jang on 30th July 2025.

Despite his own family’s involvement in the sugar sector, Sharif appears to be positioning himself on one side of a fierce ideological and regulatory battle. By refusing to compromise politically and financially, he is aiming to demonstrate state supremacy over a sector long accused of tax evasion and price manipulation.

2. The Backlash: A Market Under Siege

Far from exerting control, the sugar mafia has responded with a swift and aggressive counterattack: driving retail sugar prices through the roof. As marketplaces reel under skyrocketing prices, the general population—already under economic stress—feels betrayed by a campaign supposed to serve public interest.

This dichotomy creates confusion. On one hand, the government’s efforts are framed as fiscal reform; on the other, consumers pay the cost. Critics argue the price surge isn’t accidental—it’s a strategic reaction aimed at undermining the political goodwill from tax compliance.

3. FBR’s Numbers Game: Triumph on Paper

The Federal Board of Revenue (FBR) reports significant achievements after implementing physical monitoring teams, trace-and-track systems, and video surveillance at sugar production units. Documented sugar sales rose from Rs 107 billion to Rs 152 billion, a 41% increase within a year. This crackdown reclaimed nearly Rs 57 billion in lost tax revenue.

Moreover, similar drives in tobacco, cement, beverages, and poultry hatcheries delivered impressive tax gains—tobacco sector revenue doubled, cement industry collections soared, beverage sales tax jumped 23%, and poultry grew 50% month-over-month. Collectively, Pakistan’s tax‑to‑GDP ratio climbed from 8.8% to 10.3% in a single fiscal year, with enforcement efforts accounting for 15% growth in tax revenue, while actual economic expansion contributed just 7%.

4. Politics vs. Pragmatism: Miftah’s Inside Perspective

Miftah Ismail, Sharif’s former finance minister and now a critic, offered revealing behind‑the‑scenes context. He reminded the public that during the previous Sharif tenure, the Prime Minister rejected his suggestion to allow sugar exports—even when foreign exchange was desperately needed. Instead, Sharif favored imposing a “super tax” on the sugar industry to crackdown on excesses and profiteering—despite its political cost.

Ismail also disclosed that successive chairs of the Sugar Export Committee—Tarik Bashir Cheema and later Ishaq Dar—challenged industry numbers and resisted export approvals even as prices surged. These policy decisions signal that Sharif sought sustained regulatory control over sugar flows, rather than profiteering or barter with vested interests.

5. The Industrial Landscape: Who Holds the Cards?

Pakistan’s sugar sector is dominated by politically connected conglomerates. The Jahangir Tareen (JKT) Group holds nearly 15% market share, followed by Omni Group with around 12%. Other major players include mills owned privately by the minister of industries, the Sharif family, and those aligned with major political parties. The narrative of cartel control is real—and potent.

A senior FBR official affirmed that Shehbaz Sharif personally chaired weekly monitoring meetings, ordering strict enforcement—even when data implicated his own familial interests. Intelligence agencies like FIA and IB were also mobilized to ensure integrity in the operation of the FBR teams and to monitor performance holistically.

6. Winners and Losers: Assessing the Fallout

✅ Government

-

Fiscal Wins: A surge in tax collection across sectors rebounds positively for national budgets.

-

Political Capital: Demonstrates a willingness to challenge cronies, boosting Sharif’s populist credence.

-

Institution‑Building: Setting precedents for digital monitoring may pave the way for long‑term reform.

❌ Consumers

-

Price Pain: Swift market reactions have driven sugar costs beyond many households.

-

Trust Gap: Government signals tax credibility, but citizens bear inflation instead of benefits.

🤔 Industry Cartels

-

Short‑Term Losses: Loss of informal revenue and increased scrutiny.

-

Long‑Term Strategy: May plan to recoup losses via higher prices – a classic market retaliation or “back‑lash profiteering”.

7. Broader Implications & Policy Takeaways

This sugar saga underscores a bigger question: can Pakistan’s political will dismantle entrenched cartels without triggering systemic backlash? The sugar war is symptomatic of wider governance challenges:

-

Regulatory Integrity: Enforcement requires independence from political affiliations—even when the affiliations run deep.

-

Market Sensitivity: Fiscal reforms should balance revenue goals with consumer protection; trends like price gouging must be anticipated and cushioned.

-

Transparency & Communication: Public trust demands clarity on why prices rose even under reform, and how long policy costs will persist before benefits emerge.

8. The Road Ahead: Can the Prime Minister Sustain Momentum?

Will Sharif ultimately “win” this war? It depends:

-

If price controls are enforced and cartels are further weakened, this could become one of the rare governance wins—redistributing burden from the many to the few.

-

But if backtracking or implicit compromises occur, the sugar lobby’s message is clear: market power trumps paper fines.

The next few months will be critical:

-

Will retail sugar prices stabilize or decline?

-

Will FBR or government enforce continued price monitoring or subsidies?

-

Will export policies stay restricted, or be revised again?

9. Conclusion: Reform, Retaliation, or Retreat?

At the intersection of politics, policy, and economics, the sugar policy conflict is a microcosm for Pakistan’s civic challenges. Sharif’s attempt to break cartels may yield structural reform if continued boldly. Yet the pain inflicted on consumers could easily erode public support. For now, it’s less a question of tax dollars collected and more of public confidence preserved.

Czechangez Khan Jadoon is an Islamabad-based senoir journalist.