In the Indian city of Bengaluru, a young man who took a loan through online apps committed suicide after being fed up with the demands of repaying the loan, before he died he also left a letter addressed to his parents.

According to media reports, a 22-year-old engineering student, Tejas, had taken a loan through an online loan application, which he faced harassment from the company for non-repayment.

After being harassed several times by the company, the young man committed suicide by hanging a noose around his neck in his house.

The online application started blackmailing the young man for not repaying the loan and threatened to make the pictures stored in his mobile phone viral if he failed to repay the loan.

Police said the family of the youth said that he had taken some money as a loan from an online application which he was not repaying, and when his father came to know about it, he closed the application. Talked to the representatives and promised to pay the amount in installments.

Despite this, the representatives of the mobile application started visiting the young man’s house repeatedly and threatening him.

Three days before the youth’s death, his father had requested the representatives of the application to give him more time to pay off the loan, but the representatives flatly refused.

Tejas was forced to take this extreme step after receiving several calls from the loan application representative on Tuesday.

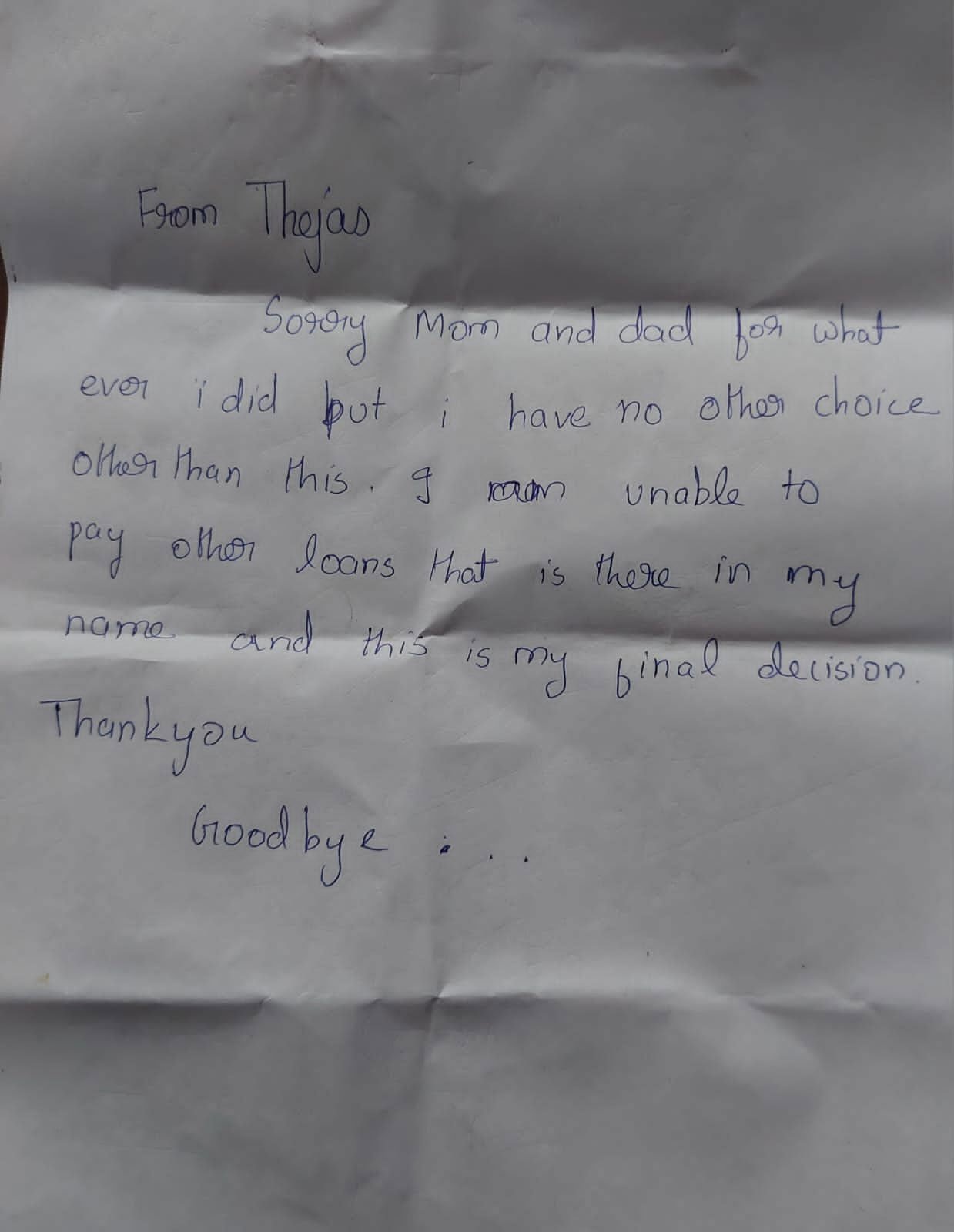

Before committing suicide, the young man also left a note to his family, in which he wrote, “I want to apologize for what I have done, I have no other choice, and I Unable to pay the other debts in the name, this is my final decision, goodbye.”

It should be noted that a similar incident happened in Rawalpindi in the past few days, in which A person named Mahmood Masood After taking a loan of 13,000 from an online company, committed suicide due to non-payment.

setTimeout(function(){

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘836181349842357’);

fbq(‘track’, ‘PageView’);

}, 6000);

/*setTimeout(function(){

(function (d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s);

js.id = id;

js.src = “//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.11&appId=580305968816694”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));

}, 4000);*/