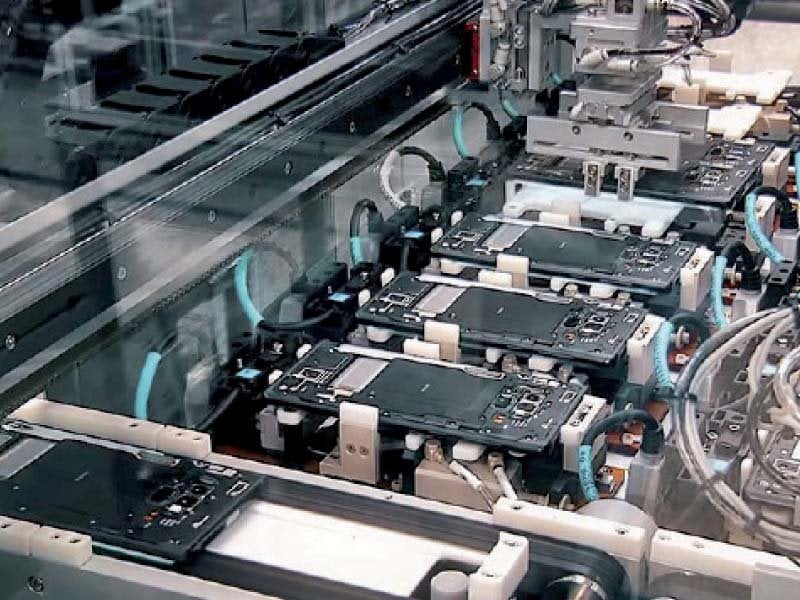

3 years ago the policy was approved for the promotion of Make in Pakistan mobile phones. Photo: File

Islamabad: Despite giving more than Rs 46 billion in tax incentives in the last financial year, the dream of Make-in-Pakistan mobile phones has come true as the government has failed to localize the manufacturing of mobile handsets in violation of state policy.

Sources told The Express Tribune that the EDB and the Ministry of Industry have failed to ensure a one- to two-year localization plan for equipment and materials used in the manufacture of mobile phones.

Three years ago, the previous government approved the Mobile Device Manufacturing Policy to promote Make-in-Pakistan mobile phones. It offered incentives in the form of reduced or waived rates of duties, sales tax and income tax aimed at encouraging manufacturers to manufacture parts locally.

The FBR’s 2021-22 Tax Expenditure Report shows that the country suffered a loss of Rs 46.2 billion due to reduction in duties and taxes collected from mobile phone manufacturers. Mobile phone manufacturers could not even ensure localization of packaging materials by the June 2022 deadline, which is the easiest task in the value chain.

According to sources, no progress has been made on the localization of mobile chargers, Bluetooth hands-free, motherboards, plastic parts, displays and batteries even by the June 2023 deadline. In the case of those who failed to get the localization of the cars.

As a result, car prices skyrocket and consumers are forced to bear the brunt of exchange rate fluctuations.

Under the localization plan, packaging materials were supposed to be removed from the list of beneficiaries of IOCO, which has not happened till date. Ministry of Industry sources said that it was EDB’s fault that it did not implement the packaging material localization plan in time. did not

Due to restrictions on imports, manufacturers were forced to reduce their production to 35% of capacity but this is also their fault, as they could not achieve even 10% localization in two years.

According to the plan, the total potential of local value addition was 49%. FBR’s tax expenditure report stated that sales tax exemption of Rs 45.9 billion was given on sale of locally assembled mobile phones. Profits and gains from mobile phone manufacturers cost another Rs 1.3 million.

Sources said the FBR should immediately remove packaging from the IOCO list for assemblers who have completed one year of production.

(function(d, s, id){

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) {return;}

js = d.createElement(s); js.id = id;

js.src = “//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.3&appId=770767426360150”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));

(function(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//connect.facebook.net/en_GB/sdk.js#xfbml=1&version=v2.7”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));